August 12/20 12:23 pm - Dorel Sports Division Reports Record Second Quarter

Posted by Editoress on 08/12/20

Dorel Industries Inc. announced on August 10th results for the second quarter and six months ended June 30, 2020. Second quarter revenue was US$724.0 million, up 8.1% from the same period a year ago. Revenue for the six months was flat at US$1.3 billion. Reported net loss was US$46.7 million or US$1.44 per diluted share, compared to US$5.5 million or US$0.17 per diluted share a year ago.

"Dorel's overall revenues have recovered sharply from the initial negative effects of COVID-19 with strong performances in two of our three segments. Dorel Sports and Dorel Home benefitted from increased demand for its products as consumers sought bicycles and home furnishing products during the prolonged lockdown periods. Increased sales of in-stock items allowed both segments to reduce inventory to record low levels," commented Dorel President & CEO, Martin Schwartz.

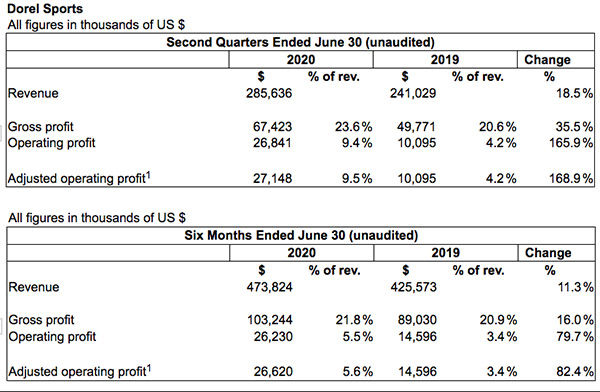

The Sports division maintained its positive momentum with the fifth consecutive quarter of growth with record profitability. Revenue was US$285.6 million, up US$44.6 million, or 18.5%, from last year. Excluding the impact of varying foreign exchange rates, organic revenue improved approximately 21.1%. The strong performance was at the Cycling Sports Group (CSG) and Pacific Cycle divisions, offset by declines at Caloi [Brazil-based bicycle brand] as revenue decreased primarily due to prolonged COVID-19 imposed store closures in Brazil.

There was a spike in demand for all types of bicycles which rose dramatically and was maintained throughout the quarter as consumers sought a healthy escape from weeks of COVID-19 lockdowns. Online sales were particularly strong with purchasing activities shifting to e-commerce at the height of the pandemic. Sales were limited by a lack of supply of certain models despite Asian suppliers re-opening in February. As a consequence, on-hand inventory dropped considerably, contributing to Dorel's overall inventory reduction in the quarter. Six-month revenue was US$473.8 million, an increase of US$48.3 million, or 11.3%, from prior year.

Operating profit was US$26.8 million compared to US$10.1 million last year. Excluding restructuring costs, adjusted operating profit was US$27.1 million, an increase of US$17.1 million, or 168.9%, from prior year. Operating profit for both CSG and Pacific Cycle was up strongly, driven by the increased demand in bicycles while Caloi registered an operating loss due to a number of factors, including sustained store closures and the shut down of its factory through April and May. Six-month operating profit was US$26.2 million compared to US$14.6 million a year ago. Excluding restructuring costs, adjusted operating profit was US$26.6 million, up US$12.0 million, or 82.4%, from last year.

Based on current trends, demand for bicycles is expected to remain strong through the summer season. On-going supply constraints will limit sales, but expectations are that third quarter revenues and adjusted operating profit will continue to be strong. The current volatility in the bicycle industry caused by the pandemic, changes in current demand levels and possibly in the seasonality of bicycle sales, is making visibility beyond the third quarter more difficult to determine.

| Return to Canadian Cyclist homepage | Back to Top |